Travelling could be one of the most thrilling experiences in your life, with a promise of new experiences and the excitement of getting exposure to something new. But the journey may also be accompanied by certain doubts. Such scenarios encompass unforeseen cancellation of tickets, health emergencies and misplaced luggage.

That’s where travel insurance steps in to act as a safety net that can assist you financially, along with other travel needs. In this aspect, being aware of whether to buy travel insurance online before, during and after booking your tickets can help you choose the best timeframe for policy activation.

Optimal Timing for Purchasing Travel Insurance

If you want optimum coverage, it is important to decide the time of purchasing travel insurance. This analysis focuses on three major options. Firstly, you can buy travel insurance before planning the trip. Secondly, you can buy the insurance at the time of booking the tickets or thirdly, after you have already got the tickets.

1. Buying Before Booking

If you opt to purchase travel insurance beforehand, you’ve a high chance of getting or losing primary facilities of these services. Thus, there are a few factors you should know to while purchasing insurance prior to booking:

● Research Opportunities: Purchasing travel insurance early allows you to get more time to compare various policies and coverage options. During this period, you can explore multiple options and their suitability with your needs.

● Risk Assessment: This time is perfect to gather vital information about the potential risks and opportunities associated with your chosen destination.

● Irrelevance of Policies: Despite being two major benefits, your travel insurance may no longer align with your needs because if your plans evolve, the policy needs might change.

2. Buying at The Time Of Booking Tickets

Buying travel insurance at the time you make and pay for travel reservations is usually the best method of securing prepaid expenses. Insurers often recommend that you purchase the policy upon first trip payment to obtain the benefits of trip cancellation.

Some of the key benefits of purchasing travel insurance during this window include:

● Cancellation Protection: Trip cancellation coverage only applies when the policy is effective on the occurrence that results in a claim.

● Accurate Alignment of Policy Dates: At the time of booking, purchasing enables the policy start and end dates to be aligned with the travel schedule, which eliminates the possibility of future changes.

● Access to Cashless Claims: Insurers like HDFC ERGO travel insurance offer you access to more than 1 lakh cashless hospitals worldwide to ensure your health during your journey.

3. Buying After Booking But Before Departure

Yes, you can also purchase travel insurance once you have finalised your vacation, and in most situations, this is a wise and sensible step. When you buy insurance, once you are done making your travel plans, you can add the correct trip information by stating the specific dates of start and end of the trip, destination, and the number of travellers. These are the inputs that are needed to find the premium right and have the policy mirror the real plan of travel.

The travellers can buy insurance after booking, and this eliminates the guesswork and chances of future adjustments to the policies. This can make administration easier, and it also makes sure that the coverage periods, individuals, and destinations are defined.

But you need to be aware of the following important considerations:

● The policy should be bought prior to departure in order to get the benefits of travel insurance.

● Events or conditions that are prior to the policy purchase are excluded.

● A purchase delayed until just before departure can limit the time of cancellation protection.

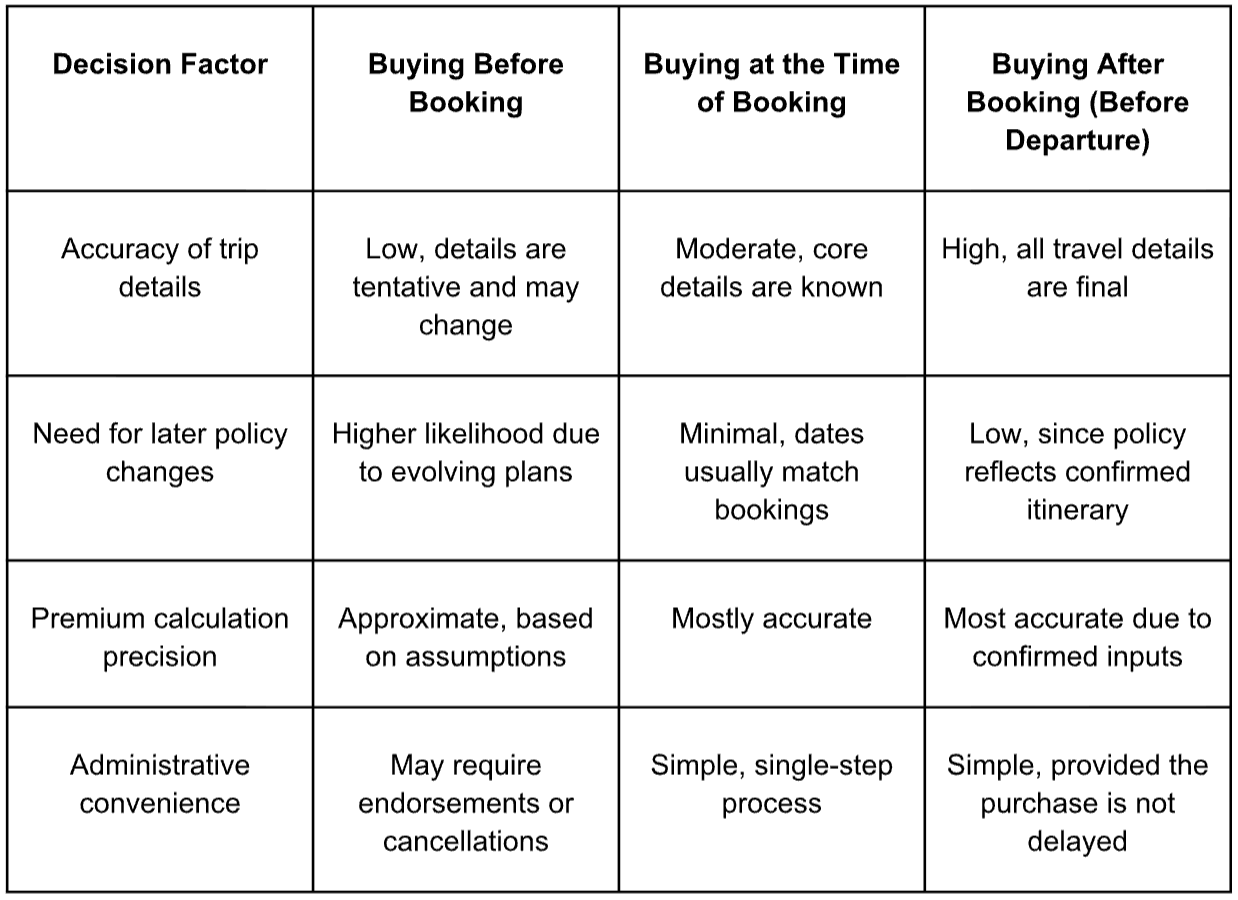

How Timing Influences Travel Insurance Decisions?

There are a few factors that may significantly fluctuate depending on the time you purchase travel insurance. Here’s what you need to look for:

Final Thoughts

Selecting the right time to buy travel insurance depends on how certain your plans are. It can be necessary to change when buying too early and limit benefits when buying too late. Purchasing travel insurance when you make the booking, or shortly after doing the same, is the most beneficial option, more protective, precise, and convenient.

Purchasing within this timeframe ensures that your coverage is up to date when you travel. It also covers you against the cancellation of flights, hospitalisation, and luggage. In this way, you will be able to get a trip without any financial or logistical hassles.

Planing your next trip? Read these articles next:

- 6 Travel Hacks for Frequent Flyers: Getting the Most Out of Your Airline Miles

- Travel Tech Essentials: The Ultimate Guide to Gadgets & Apps for a Smooth Vacation

- The Best Destinations for Winter Sun Holidays

Enjoyed this article on when to buy travel insurance? Pin it!